Rivian and Volkswagen have joined forces with a 50/50 joint venture and will inject a total of $5 billion into the struggling electric vehicle maker. The partnership solves problems for both sides but the road ahead is not perfectly paved.

Initial Injection Of Cash, With More Later

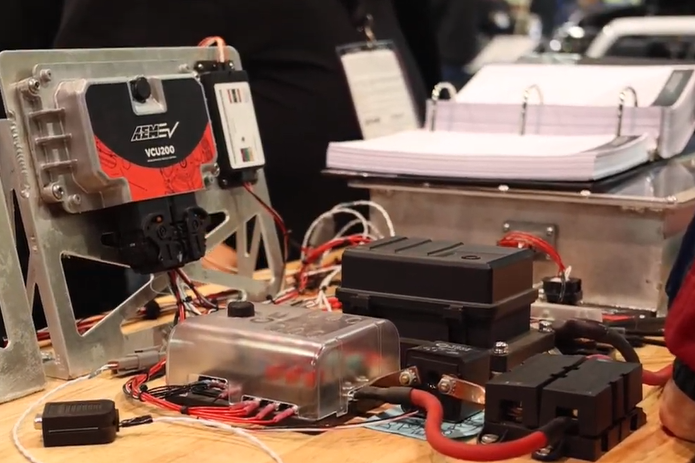

Initially, VW will inject $1 billion, and then an additional $4 billion as milestones are achieved. The partnership will focus on developing advanced electrical hardware and coding technology, with Rivian’s expertise in software and zonal electronics being central to the venture.

Shares of Rivian surged about 50 percent in extended trade after the announcement, potentially supercharging the company’s market value by nearly $6 billion.

The collaboration aims to introduce VW Group vehicles equipped with Rivian technology in the latter half of the decade. While no specific models have been mentioned, it’s likely that VW’s Scout EV brand, reminiscent of the International Harvester trucks from 1960 to 1980, is the target for this technology. Scout is rumored to have a starting price of around $40,000, similar to Rivian’s R2 SUV expected in 2026. This financial boost from VW could be crucial in bringing new Rivian models to market.

The joint venture will be led by two CEOs, each representing one of the parent companies. This structure is designed to ensure that both Volkswagen and Rivian have equal input in the direction of the venture.

In an interesting turn of events, Volkswagen’s troublesome software subsidiary, Cariad, will continue its operations independently. The joint venture’s work with Rivian will complement Cariad’s efforts, not replace them. This collaboration marks a significant step in Volkswagen’s strategy to enhance its electric vehicle offerings and software capabilities.

This is not the first cash infusion Rivian has secured. It had a partnership with Ford that was dissolved during the pandemic and it’s still producing vans with its “side chick” Amazon. Regardless of how many times Rivian has been to the alter, this latest union is a precursor to future consolidation in the EV space.

Five Takeaways From The Rivian And Volkswagen Joint Venture:

If At First You Don’t Succeed, Write A Check

Making EVs is not for the faint of heart. Creating code for software-defined vehicles (SDVs) is even harder. Volkswagen went through massive teething pains with Cariad software for its ID series of EVs. Chevrolet and Volvo are other victims of similar delays, despite the two being early out of the EV gates with some of the best OEM products on the market.

No OEM is immune. Elon Musk slept at Tesla’s Fremont factory while the company went through “production hell.” General Motors is just now reaching production targets for EV models released in 2022 because it needed to get the software right. Nonetheless, the otherwise excellent Chevrolet Blazer EV still had a stop-sell. Volkswagen needs validated software and hardware it can integrate into its product line pronto and Rivian is more than happy to offer up some financial buoyancy.

Beggars And Borrowers

With the EV market sluggish (for now) and hurdles to mass adoption lingering, the trend of OEMs mixing and matching components, software architecture, or buying complete chassis is the wave of the future. Honda has put its Prologue and Acura ZDX “tophats” on GM’s Ultium platform, Stellantis poured $1.6 billion into buying a 21 percent stake in China’s Leapmotor, (not to mention Dongfeng) and now we have VW snapping up a chunk of Rivian for its software expertise.

There are political implications as well. By opening up a factory with Leapmotor in Poland, Sellantis can leverage China’s inherent low cost and avoid a tariff or two. Whether VW can garner Inflation Reduction Act bucks remains to be seen, but investing in North America amasses tangible political wampum.

Crowded House

VW secured the brand name Scout years ago and has been quietly toiling away getting ready to reintroduce it to the lucrative North American market. Integrating Rivian’s validated software and zonal electronics avoids a big throbbing headache for VW, not to mention speeding up the timeline.

A boatload of German euros is also supposed to grease the runway for the smaller R2 and give Rivian a much-needed life line. The only fly in the ointment is some overlap between the Rivian R2 and future Scout models.

Shotgun Marriage

Both companies need each other. Rivian is far from profitable and is fighting for its life, despite all the glowing reviews and its most favored status (second only to Tesla) with moneyed EV buyers. VW’s lineup in the US is threadbare, to say the least. The ID.4 is doing okay, but the gas-guzzling Atlas SUV is what’s keeping the enterprise afloat in the US.

VW desperately needs more trucks and utility vehicles. Volkswagen said earlier this year it was sticking with plans to launch 25 EV models in North America across its group brands by 2030, and this JV is an admission that it can’t create the software it needs by itself. The company’s shares are down around 3 percent so far this year.

What Could Go Wrong?

Combining two CEOs is never a good idea and neither entity will be a majority stakeholder. Not to mention, the market isn’t going to get any less complicated. GM, Ford, Stellantis, and Tesla have now invaded the truck space that Rivian once had all to itself. The slice of truck market share that Rivian can commandeer seems finite to say the least. Two new SUVs added to the portfolio will diversify their lineup, but competition is even more formidable in the SUV segment, making up 25 percent of all sales in North America.

Final Word On The Rivian And Volkswagen Joint Venture

The world will be watching to see if this VW/Rivian hookup bears fruit, or if it’s a replay of the Daimler-Chrysler “merger of equals” debacle way back in 1998. The key question is, will VW eventually swallow Rivian whole? This author thinks VW wants the entire franchise. Instead of creating the Scout brand from scratch, dropping “top hat” bodies on top of Rivian chassis would save VW spending billions, twice. Whatever happens, the “Great Consolidation” of the auto industry is full steam ahead.